Soligenix (SNGX) is a biodefense and biotherapeutics company that is putting nine different development programs through the early stages of clinical development. They are quite famous in the vaccine world for the continued development of a vaccine-stabilizing technology known as ThermoVax™. This technology, which was originally developed at Harvard, will make a huge difference in vaccine storage and utility in coming years.

The company is only trading at a valuation of $40 million despite the sheer size of the product pipeline. We think the company could see uplisting to NASDAQ before the end of the year, and we see that the company makes every effort to find non-dilutive sources of capital.

On top of the many value-driving catalysts that are en route, we see two big reasons to like this stock right now:

I – Melioidosis & SGX943/SGX101 Programs

Melioidosis is a very serious bacteria-induced disease with a 40% mortality rate. Most patients that present with Melioidosis are residents of the southeastern regions of Asia, although the bacteria does have a presence in Australia too.

Currently, there are no effective vaccines to prevent melioidosis. We see the Soligenix program as a potential solution to a very serious problem in Asia/Australia, and as a great commercial opportunity for investors.

The disease is caused by a resilient species of bacteria known as Burkholderia pseudomallei, which enters the body through the digestive tract and through cuts in the skin. Since it is quite resistant to general antibiotic therapies, hospitals in developing areas are ill-equipped to help patients with severe Melioidosis. B. Pseudomallei is dangerous enough to be considered a potential bioweapon by the Department of Health and Human Services.

The Soligenix melioidosis program was promising enough to attract the attention of Intrexon – a biotechnology company that is famously supported and led by billionaire RJ Kirk. A collaboration arrangement was made in May 2013 for the SGX101 program. In June 2013, it was also announced that RJ Kirk participated in a $7.1 M offering by Soligenix through his fund Third Security.

It is important to note that SGX943 is different from SGX101. SGX943 is a compound that improves the immune system response to bacterial infection. Given the lack of human data we cannot favor SGX943 or SGX101 at this point.

II –Diversification

Soligenix is diversified in terms of its funding, and in terms of its product portfolio. The company attracts funding from government, institutional, and individual sources to develop ten different vaccines/therapies.

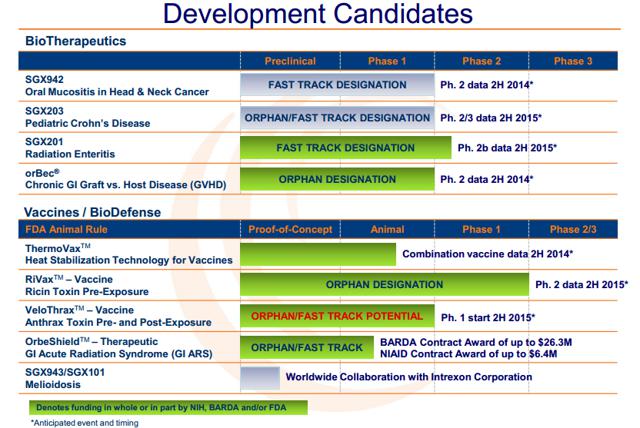

Soligenix has access to non-dilutive funding from government agencies who are looking to support promising biodefense products that show up on their radar. Development of six out of the nine vaccines or therapeutics in the Soligenix pipeline are partially/wholly funded by the NIH, BARDA, or the FDA. This makes it feasible for a small company like Soligenix to work on a huge pipeline (shown below) without the excessive cash burn.

In 2013, BARDA/NIAD awarded Soligenix with two grants worth up to $26 and $6 M for the development of OrbeShield - a drug for GI Acute Radiation Syndrone. We should be getting more data from this drug in the second half of 2014, and we give a nod to Soligenix for the low-cost development of this niche product.

Top India Stocks To Own For 2015

Soligenix is current traded on the OTC bulletin board, which makes it inaccessible for most financial institutions. However, Soligenix was able to secure a $10.6 M stock purchase agreement over a 36-month period from Lincoln Park Capital. If it uplists to Nasdaq, we see a lot of potential for additional institutional support. This should allow the company to smoothly move multiple candidates into late-stage development.

We will be updating the Soligenix story accordingly. Stay tuned!

No comments:

Post a Comment