Two and a half hours into trading, American International Group (NYSE: AIG ) stock is up 0.6% as investors ride a Fed-induced market wave and confidently shrug off being designated a SIFI.

This just in

SIFI stands for Systemically Important Financial Institution. The designation was coined as part of 2010's Dodd-Frank financial reform act. Yesterday, the Financial Stability Oversight Council announced that AIG, along with GE Capital, would be designated SIFIs: the first two non-banks to receive this dubious honor.�

In market news, the minutes from the Federal Reserve's June 19 Federal Open Market Committee meeting were released yesterday. Rabid dissection of the discussion behind the FOMC's previous announcement that quantitative easing would be tapered as soon as this year revealed dissension in the ranks, with many Fed governors arguing not to taper too soon.�

Foolish bottom line

What does it mean for AIG's bottom line that it was designated a SIFI? Like its now-brethren SIFI-designated banks, the insurance giant will be held to higher capital-reserve levels. And just like with banks, capital held in reserve is capital not out there making money for the business and for shareholders.

RSA Insurance Group plc is the holding company of the RSA group of companies whose principal activity is the transaction of personal and commercial general insurance business. The Company operates in four segments: Scandinavia, Canada, United Kingdom and Western Europe, and Emerging Markets. The Company provides insurance covers for a range of renewable energy technologies, including Wind Energy, which includes onshore and offshore facilities; Solar Energy, which includes photovoltaic, concentrated and thermal installations; Small Hydro, which includes power stations producing an output up to 50 megawatt, and Bio energy, which includes Biomass, Biogas and Waste to Energy plants. The Company works with both large and small brokers. The Company works with partners, such as building societies, banks, retailers, motor manufacturers, charities, utilities and unions to offer their customers appropriate insurance products.

Advisors' Opinion: - [By Sofia Horta e Costa]

RSA Insurance Group Plc (RSA), which insures cars, homes and ships in the U.K., Scandinavia and emerging markets, rose 0.8 percent to 114.1 pence. Morgan Stanley raised its rating on the stock to overweight, the equivalent of a buy recommendation, from underweight.

Hot Insurance Companies To Watch In Right Now: Arthur J. Gallagher & Co. (AJG)

Arthur J. Gallagher & Co. (Gallagher), along with its subsidiaries, provides insurance brokerage and third-party claims settlement, and administration services to entities in the United States and abroad. It operates in three segments: brokerage, risk management and corporate. The Brokerage segment primarily consists of retail and wholesale insurance brokerage operations. The Company�� risk management segment provides contract claim settlement and administration services for enterprises that choose to self-insure some or all of their property/casualty coverages and for insurance companies that choose to outsource some or all of their property/casualty claims departments. Majority of its international brokerage operations are in Australia, Bermuda, Canada and the United Kingdom. Its international risk management operations are principally in Australia, Canada, New Zealand and the United Kingdom. The Company operates in Australia and Canada primarily as a retail commercial property and casualty broker. In December 2013, the Company announced that it has completed the acquisition of Barmore Insurance Agency, Inc. In December 2013, Arthur J. Gallagher & Co. acquired McIntyre Risk Management, LLC. In December 2013, the Company acquired Cleaveland Insurance Group and Jenkins and Associates. Effective December 26, 2013, Arthur J Gallagher & Co acquired Rock Island-based Cleaveland Insurance Group. In February 2014, Arthur J. Gallagher & Co acquired Benefit Development Group of Selma, Alabama. In February 2014, Arthur J. Gallagher & Co announced the acquisition of Kent, Kent & Tingle in Shreveport, Louisiana.

Brokerage Segment

The Company�� retail brokerage operations negotiate and place property/casualty, employer-provided health and welfare insurance and retirement solutions principally for middle-market commercial, industrial, public entity, religious and not-for-profit entities. Many of the Company�� retail brokerage customers choose to place their insurance with insurance ! underwriters, while others choose to use alternative vehicles, such as self-insurance pools, risk retention groups or captive insurance companies. Its wholesale brokerage operations assist its brokers and other unaffiliated brokers and agents in the placement of specialized, and hard-to-place insurance programs.

The Company�� primary sources of compensation for its retail brokerage services are commissions paid by insurance carriers. It operates its brokerage operations through a network of more than 300 sales and service offices located throughout the United States and in 16 other countries. In addition, the Company offers client-service capabilities in more than 110 countries worldwide through a network of correspondent brokers and consultants. The Company�� retail brokerage operations place all lines of commercial property/casualty and health and welfare insurance coverage. Its retail brokerage operations are organized in more than 190 geographical centers located in the United States, Australia, Canada and the United Kingdom and operate within certain key niche/practice groups, which account for approximately 67% of its retail brokerage revenues.

During the year ended December 31, 2011, the Company�� wholesale insurance brokerage operations accounted for 22% of its brokerage segment revenues. Its wholesale brokers assist its retail brokers and other non-affiliated brokers in the placement of specialized and hard-to-place insurance. These brokers operate through over 65 geographical centers located across the United States, Bermuda and through its approved Lloyd�� of London brokerage operation. In certain cases, it acts as a brokerage wholesaler, and in other cases, it acts as a managing general agent or managing general underwriter distributing specialized insurance coverages for insurance carriers. Over 75% of the Company�� wholesale brokerage revenues come from non-affiliated brokerage customers.

Risk Management Segment

The Company�� ! risk mana! gement segment provides contract claim settlement and administration services for enterprises that choose to self-insure some or all of their property/casualty coverages and for insurance companies that choose to outsource some or all of their property/casualty claims departments. During 2011, approximately 67% of its risk management segment�� revenues were from workers compensation related claims, 26% were from general and commercial auto liability related claims and 7% were from property related claims. In addition, it generate revenues from integrated disability management (employee absence management) programs, information services, risk control consulting (loss control) services and appraisal services, either individually or in combination with arising claims. The Company manages its third-party claims adjusting operations through a network of approximately 110 offices located throughout the United States, Australia, Canada, New Zealand and the United Kingdom.

The Company competes with Aon Corporation, Marsh & McLennan Companies, Inc., Willis Group Holdings, Ltd., Wells Fargo Insurance Services, Inc., Brown & Brown Inc., Hub International Ltd., Lockton Companies, Inc., USI Holdings Corporation, Aon Hewitt, Towers Watson & Co., Crump Group, Inc., CRC Insurance Services, Inc., RT Specialty, AmWINS Group, Inc., Swett & Crawford Group, Inc., Sedgwick Claims Management Services, Inc., Crawford & Company, ACE Limited, AIG Insurance and Zurich Insurance.

Advisors' Opinion: - [By Jonas Elmerraji]

We're seeing the same exact price setup in shares of mid-cap insurance broker Arthur J. Gallagher (AJG) -- just in the shorter-term. AJG has been forming an ascending triangle setup of its own since the beginning of May, hitting its head on resistance at $45.50. That's the breakout level to watch in shares this week.

Whenever you're looking at any technical price pattern, it's critical to think in terms of buyers and sellers. Ascending triangles and other price pattern names are a good quick way to explain what's going on in this stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That resistance line at $45.50 is a price where there's an excess of supply of shares; in other words, it's a place where sellers have been more eager to take recent gains and sell their shares than buyers have been to buy. That's what makes the move above it so significant -- a breakout indicates that buyers are finally strong enough to absorb all of the excess supply above that price level. Wait for that signal to happen before you jump into this stock.

Hot Insurance Companies To Watch In Right Now: Helvetia Holding AG (HELN)

Helvetia Holding AG is a Switzerland-based holding company of the Helvetia Group, an internationally active, all-lines insurance service group. The Company divides its activities into country markets Switzerland, Germany, Italy, Spain and Other insurance units, which include Austria, France and the global reinsurance business, as well as the Corporate segment, which includes all the Helvetia Group activities, as well as financing companies and the Company. Helvetia Holding AG classifies its activities as life business, non-life business and other activities. The life business offers life insurance, pension plans and annuities, among others. The non-life business includes property, motor vehicle, liability and transport policies, as well as health and accidental insurance coverage. The reinsurance business, among others, is included in Other activities business. The Company operates through its branch offices and subsidiaries.

Advisors' Opinion: - [By Tom Stoukas]

Helvetia Holding AG (HELN) added 3.3 percent to 412 Swiss francs. Switzerland�� fourth-biggest insurer said first-half profit rose because of increased life-insurance sales and an acquisition in France. Net income climbed to 179.5 million Swiss francs ($192 million) in the six months through June, beating the average analyst estimate of 164.4 million francs.

Hot Insurance Companies To Watch In Right Now: ACE Ltd (ACE)

ACE Ltd (ACE) is a holding company of the ACE Group of Companies. ACE is a global insurance and reinsurance organization, serving the needs of customers in more than 170 countries. It offers commercial insurance products and service offerings, such as risk management programs, loss control and engineering and complex claims management. It also provides specialized insurance products ranging from Directors & Officers (D&O) and professional liability to various specialty-casualty and umbrella and excess casualty lines to niche areas, such as aviation and energy. In addition, it supplies personal accident, supplemental health, and life insurance to individuals in select countries. ACE operates in four business segments: Insurance-North American, Insurance-Overseas General, Global Reinsurance, and Life. In December 2011, it acquired Rio Guayas Compania de Seguros y Reaseguros, a general insurance company in Ecuador. On November 30, 2011, it acquired Penn Millers Holding Corporation (PMHC). On April 1, 2011, it acquired the operations of New York Life�� Hong Kong. On February 1, 2011, ACE acquired New York Life�� Korea operations. In September 2012, it acquired 80% of PT Asuransi Jaya Proteksi in Indonesia.

Insurance-North American

ACE�� Insurance-North American segment consists of the operations in the United States, Canada, and Bermuda. This segment includes the operations of ACE USA (including ACE Canada), ACE Bermuda, ACE Commercial Risk Services, ACE Private Risk Services, ACE Westchester, ACE Agriculture, and various run-off operations. During the year ended December 31, 2011, Insurance-North American segment accounted for 45% of its consolidated net premiums earned. During 2011, ACE USA represented approximately 49% of Insurance-North American�� net premiums earned.

ACE USA is the North American retail operating division which provides a broad array of P&C, A&H, and risk management products and services to a diverse group of commercial and non-commercia! l enterprises and consumers. ACE Bermuda provides commercial insurance products on an excess basis mainly to a global client base, covering exposures that are generally low in frequency and high in severity. ACE Commercial Risk Services addresses the insurance needs of small to mid-sized businesses in North America by delivering an array of specialty product solutions for targeted industries. ACE Private Risk Services provides personal lines coverages for high net worth individuals and families in North America.

ACE Westchester specializes in the North American wholesale distribution of excess and surplus P&C, environmental, professional and inland marine products. ACE Agriculture provides Multi-Peril Crop Insurance and crop/hail insurance protection to customers throughout the United States and Canada through Rain and Hail and Agribusiness insurance through Penn Millers Insurance Company. The run-off operations include Brandywine, Commercial Insurance Services, residual market workers��compensation business, pools and syndicates not attributable to a single business group, and other exited lines of business. Run-off operations do not actively sell insurance products, but are responsible for the management of existing policies and settlement of related claims.

Insurance-Overseas General

During 2011, ACE�� Insurance- Overseas General segment accounted for 37% of its consolidated net premiums earned. Insurance-Overseas General segment consists of ACE International, its global retail insurance operations, the wholesale insurance business of ACE Global Markets, and the international A&H and life business of Combined Insurance. ACE International is its retail business serving local companies and insureds to large multinationals outside the United States, Bermuda, and Canada. ACE Global Markets, its London-based excess and surplus lines business, includes Lloyd�� of London (Lloyd��) Syndicate 2488 (Syndicate 2488). ACE provides a fund at Lloyd�� to support und! erwriting! by Syndicate 2488, which is managed by ACE Underwriting Agencies Limited. The reinsurance operation of ACE Global Markets is included in the Global Reinsurance segment.

Property insurance products include traditional commercial fire coverage, as well as energy industry-related, construction, and other technical coverages. Principal casualty products are commercial primary and excess casualty, environmental, marine and general liability. ACE International specialty coverages include D&O professional indemnity, energy, aviation, political risk and specialty personal lines products. The A&H operations primarily offer personal accident and supplemental medical products to meet the insurance needs of individuals and groups outside of United States insurance markets. ACE International�� personal lines operations provide specialty products and services designed to meet the needs of specific target markets and include property damage, auto, homeowners, and personal liability.

Global Reinsurance

During 2011, ACE�� Global Reinsurance segment, which accounted for 7% of its consolidated net premiums earned. Global Reinsurance segment represents ACE�� reinsurance operations comprising ACE Tempest Re Bermuda, ACE Tempest Re USA, ACE Tempest Re International, and ACE Tempest Re Canada. The Global Reinsurance segment also includes ACE Global Markets��reinsurance operations. Global Reinsurance markets its reinsurance products worldwide under the ACE Tempest Re brand name and provides a range of coverage to a diverse array of primary P&C companies. ACE Tempest Re Bermuda principally provides property catastrophe reinsurance, on an excess of loss basis globally to insurers of commercial and personal property. ACE Tempest Re Bermuda underwrites reinsurance principally on an excess of loss basis, meaning that its exposure only arises after the ceding company�� accumulated losses have exceeded the attachment point of the reinsurance policy. ACE Tempest Re Bermuda also writes ! other typ! es of reinsurance on a limited basis for selected clients.

ACE Tempest Re USA writes all lines of traditional and specialty P&C reinsurance for the United States market, principally on a treaty basis, with a focus on writing property per risk and casualty reinsurance. ACE Tempest Re USA underwrites reinsurance on both a proportional and excess of loss basis. ACE Tempest Re International provides P&C treaty reinsurance to insurance companies worldwide. ACE Tempest Re Canada offers an array of traditional and specialty P&C reinsurance to the Canadian market, including casualty, property risk and property catastrophe.

Life

During 2011, ACE�� Life accounted for 11% of 2011 consolidated net premiums earned. Life includes ACE�� international life operations (ACE Life), ACE Tempest Life Re (ACE Life Re), and the North American supplemental A&H and life business of Combined Insurance. ACE Life provides individual life and group insurance, including Egypt, Indonesia, Taiwan, Thailand, Vietnam, the United Arab Emirates, throughout Latin America, selectively in Europe, as well as China through a non-consolidated joint venture insurance company.

ACE Life offers a portfolio of protection and savings products, including whole life, endowment plans, individual term life, group term life, group medical, personal accident, universal life, and unit linked contracts. ACE Life sells to consumers through a range of distribution channels, including agency, bancassurance, brokers, and direct to consumer marketing. ACE Life Re helps clients (ceding companies) manage mortality, morbidity, and lapse risks embedded in their books of business. ACE Life Re�� business is a Bermuda-based operation, which provides reinsurance to primary life insurers, focusing on guarantees included in certain fixed and variable annuity products and also on more traditional mortality reinsurance protection. ACE Life Re is a United States-based traditional life reinsurance operation. Combined I! nsurance ! distributes specialty individual accident and supplemental health and life insurance products targeted to middle income consumers in the United States and Canada.

Advisors' Opinion: - [By Ben Levisohn]

For the past several years, Berkshire has contrasted its own cost-free float provided by profitable underwriting against the industry�� (unimpressive) tendency to lose money on underwriting while generating net returns from investment income. So far, so good. Less edifying, though, is the repeated contrast of Berkshire�� track record of profitability to State Farm��…even though, as a mutual company, State Farm�� profitability goals are inherently different from for-profit insurers like Berkshire. It�� true that through year-end 2013, Berkshire�� underwriters have ��ow operated at an underwriting profit for eleven consecutive years,��but so have ACE (ACE), American Financial (AFG),� AmTrust Financial (AFSI), Arch Capital (ACGL), Chubb (CB), HCC (HCC), Progressive (PGR), RLI (RLI), and W.R. Berkley (WRB), any or all of whom provide a more meaningful comparison than contrasting Berkshire�� results to a company that�� not out to produce a profit in the first place.

- [By Damian Illia]

ACE Limited (ACE) is an insurance and reinsurance organization. The company provides commercial insurance products and service offerings such as risk management programs, loss control and engineering and complex claims management. The company�� segments are: Insurance - North American, Insurance - Overseas General, Global Reinsurance, and Life.

- [By Dividends4Life]

This week a few companies answered the call and rewarded their shareholders with higher cash dividends:

Consolidated Edison Inc. (ED) engages in regulated electric, gas, and steam delivery businesses. January 16th the company increased its quarterly dividend 2.4% to $0.63 per share. The dividend is payable March 15, 2014, to stockholders of record on February 12, 2014. The yield based on the new payout is 4.7%.

Cousins Properties Incorporated (CUZ), a real estate investment trust (REIT), owns, develops, and manages real estate portfolio, as well as performs certain real estate-related services. January 16th the company increased its quarterly dividend 66.7% to $0.075 per share. The dividend is payable February 24, 2014, to stockholders of record on February 10, 2014. The yield based on the new payout is 2.8%.

Wisconsin Energy Corporation (WEC) generates and distributes electric energy, as well as distributes natural gas. The company operates in two segments, Utility Energy and Non-Utility Energy. January 16th the company increased its quarterly dividend 2% to $0.3900 per share. The dividend is payable March 1, 2014, to stockholders of record on February 14, 2014. The yield based on the new payout is 3.8%.

BlackRock Inc. (BLK) is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors. January 16th the company increased its quarterly dividend 14.9% to $1.93 per share. The dividend is payable March 24, 2014, to stockholders of record on March 7, 2014. The yield based on the new payout is 2.4%.

ONEOK Inc. (OKE) operates as a diversified energy company in the United States. January 15th the company increased its quarterly dividend 5.3% to $0.40 per share. The dividend is payable February 18, 2014, to stockholders of record on February 10, 2014. The yield based on the new payout is 2.5%.

Omega Healthcare Investors Inc. (OHI) is a real es

- [By Ben Levisohn]

JPMorgan Chase (JPM) and American Express (AXP) rose 2% and 2.1%, respectively, as financial stocks gained on speculation that the jobless claims data would spur the Federal Reserve to taper sooner rather than later, while Ace Ltd.�(ACE) rose 3.8%. �General Motors�(GM) gained 1.1% after the US government said it could sell the last of its shares by year-end. On the downside, Target (TGT) fell 3.5% after reporting earnings that missed analyst expectations.

Hot Insurance Companies To Watch In Right Now: Anthem Inc (ANTM)

Anthem, Inc., formerly WellPoint, Inc. (WellPoint), incorporated on July 17, 2001, is a health benefit company. The Company manages its operations through three segments: Commercial, Consumer, and Other. The Company is an independent licensee of the Blue Cross and Blue Shield Association (BCBSA), an association of independent health benefit plans. The Company offers a spectrum of network-based managed care plans to the large and small employer, individual, Medicaid and senior markets. Its managed care plans include preferred provider organizations (PPOs); health maintenance organizations (HMOs); point-of-service plans (POS) plans; traditional indemnity plans and other hybrid plans, including consumer-driven health plans (CDHPs); and hospital only and limited benefit products.

The Company serves its members as the Blue Cross licensee for California and as the Blue Cross and Blue Shield (BCBS), licensee for Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri (excluding 30 counties in the Kansas City area), Nevada, New Hampshire, New York (as BCBS in 10 New York city metropolitan and surrounding counties, and as Blue Cross or BCBS in selected upstate counties only), Ohio, Virginia (excluding the Northern Virginia suburbs of Washington, District of Columbia), and Wisconsin. The Company does business as Anthem Blue Cross, Anthem Blue Cross and Blue Shield, Blue Cross and Blue Shield of Georgia, Empire Blue Cross Blue Shield, or Empire Blue Cross (in its New York service areas). The Company also serves customers throughout the country as UniCare and in certain California, Arizona and Nevada markets.

The Company provides an array of managed care services to self-funded customers, including claims processing, underwriting, stop loss insurance, actuarial services, provider network access, medical cost management, disease management, wellness programs and other administrative services. The Company also provides an array of specialty products and services including life a! nd disability insurance benefits, dental, vision, behavioral health benefit services, radiology benefit management, analytics-driven personal health care guidance and long-term care insurance. The Company provides services to the Federal Government in connection with the Federal Employee Program (FEP), and various Medicare programs.

The Company�� Commercial and Consumer segments both offers a diversified mix of managed care products, including PPOs, HMOs, traditional indemnity benefits and POS plans, as well as a variety of hybrid benefit plans including CDHPs, hospital only and limited benefit products. Its Commercial segment includes Local Group (including UniCare), National Accounts and certain other ancillary business operations (dental, vision, life and disability and workers��compensation). Business units in the Commercial segment offer fully-insured products and provide an array of managed care services to self-funded customers, including claims processing, underwriting, stop loss insurance, actuarial services, provider network access, medical cost management, disease management, wellness programs and other administrative services.

The Company�� Consumer segment includes senior, state-sponsored and individual businesses. Its senior business includes services, such as Medicare Advantage (including private fee-for-service plans and special needs plans), Medicare Part D, and Medicare Supplement, while its State-Sponsored business includes its managed care alternatives for Medicaid and State Children�� Health Insurance Plan programs. Individual business includes individual customers under age 65 and their covered dependents. Its Other segment includes the Comprehensive Health Solutions business unit (CHS). Its Other segment also includes results from its Federal Government Solutions (FGS), business. FGS business includes FEP and National Government Services, Inc. (NGS), which acts as a Medicare contractor in several regions across the nation.

Preferred P! rovider O! rganization products offer the member an option to select any health care provider, with benefits reimbursed by the Company at a higher level when care is received from a participating network provider. Consumer-Driven Health Plans (CDHPs) provide consumers with increased financial responsibility, choice and control regarding how their health care dollars are spent. Indemnity products offer the member an option to select any health care provider for covered services. Health Maintenance Organization (HMO) products include managed care benefits, generally through a participating network of physicians, hospitals and other providers. Point-of-Service (POS) products blend the characteristics of HMO, PPO and indemnity plans.

The Company provides administrative services to large group employers that maintain self-funded health plans. These administrative services include underwriting, actuarial services, medical management, claims processing and other administrative services for self-funded employers. Self-funded health plans are also able to use its provider networks and to realize savings through its negotiated provider arrangements, while allowing employers the ability to design certain health benefit plans in accordance with their own requirements and objectives. The Company also underwrites stop loss insurance for self-funded plans.

BlueCard host members are generally members who reside in or travel to a state in which a WellPoint subsidiary is the Blue Cross and/or Blue Shield licensee and who are covered under an employer sponsored health plan serviced by a non-WellPoint controlled BCBS licensee, who is the home plan. The Company performs certain administrative functions for BlueCard host members, for which it receives administrative fees from the BlueCard members��home plans. Other administrative functions, including maintenance of enrollment information and customer service, are performed by the home plan. The Company offers a variety of senior plans, products and options, ! such as M! edicare supplement plans, Medicare Advantage (including private fee-for-service plans and special needs plans) and Medicare Part D Prescription Drug Plans (Medicare Part D). Medicare Advantage plans provide Medicare beneficiaries with a managed care alternative to traditional Medicare and often include a Medicare Part D benefit. In addition, its Medicare Advantage special needs plans provide Medicare beneficiaries who have chronic diseases and conditions with tailored benefits designed to meet their needs. Medicare Part D offers a prescription drug plan to Medicare and dual eligible (Medicare and Medicaid) beneficiaries. The Company offers these plans to customers through its health benefit subsidiaries throughout the country, including CareMore.

The Company offers a range of health insurance plans with a variety of options and deductibles for individuals under age 65 who are not covered by employer-sponsored coverage. Some of its products target certain demographic populations, such as uninsured younger individuals between the ages of 19 and 29, families and those transitioning between jobs or early retirees. The Company has contracts to serve members enrolled in Medicaid, State Children�� Health Insurance programs and other publicly funded health care programs for low income and/or high medical risk individuals. The Company provides services in California, Indiana, Kansas, Massachusetts, New York, South Carolina, Texas, Virginia, West Virginia and Wisconsin. It markets and sells an integrated prescription drug product to both fully-insured and self-funded customers through its health benefit subsidiaries throughout the country. The product includes features, such as drug formularies, a pharmacy network and maintenance of a prescription drug database and mail order capabilities. The Company has delegated certain functions and administrative services related to its integrated prescription drug products to Express Scripts, under a 10 year contract. Express Scripts manages the network of ph! armacy pr! oviders, operates mail order pharmacies and processes prescription drug claims on its behalf, while it sells and support the product for clients, make formulary decisions and set drug benefit design strategy and provide front line member support.

The life products include term life and accidental death and dismemberment. The Company offers short-term and long-term disability programs, usually in conjunction with its health plans. The Company offers specialized behavioral health plans and benefits management. These plans cover mental health and substance abuse treatment services on both an inpatient and an outpatient basis. The Company offers outpatient diagnostic imaging management services to health plans. These services include utilization management for advanced diagnostic imaging procedures, network development and optimization, patient safety, claims adjudication and provider payment. The Company offers evidence based and analytics-driven personal health care guidance.

The Company�� dental plans include networks in certain states in which it operates. Many of the dental benefits are provided to customers enrolled in its health plans and are offered on both a fully-insured and self-funded basis. Its members also have access to additional dental providers through its participation in the National Dental GRID, a national dental network developed by and for BCBS plans. Additionally, the Company offers managed dental services to other health care plans to assist those other health care plans in providing dental benefits to their customers. Its vision plans include networks within the states where the Company operates. Many of the vision benefits are provided to customers enrolled in its health plans and are offered on both a fully-insured and self-funded basis.

The Company offers long-term care insurance products to its California members through a subsidiary. The long-term care products include tax-qualified and non-tax qualified versions of a skilled nursing home care! plan and! comprehensive policies covering skilled, intermediate and custodial long-term care and home health services. Through its subsidiary, NGS, the Company serves as a fiscal intermediary, carrier and Medicare administrative contractor providing administrative services for the Medicare program, which generally provides coverage for persons who are 65 or older and for persons who are disabled or with end-stage renal disease. Part A of the Medicare program provides coverage for services provided by hospitals, skilled nursing facilities and other health care facilities. Part B of the Medicare program provides coverage for services provided by physicians, physical and occupational therapists and other professional providers, as well as certain durable medical equipment and medical supplies.

Advisors' Opinion: - [By Sean Williams]

This is extremely important for Anthem (NYSE: ANTM ) (formerly WellPoint) which was the big Obamacare enrollment winner last year and has banked its success on courting Medicaid expansion enrollees as well. California's strong Medi-Cal enrollment so far is encouraging, but I'd reserve judgment until Anthem's fourth-quarter earnings report.

Hot Insurance Companies To Watch In Right Now: CNO Financial Group Inc. (CNO)

CNO Financial Group, Inc., through its subsidiaries, engages in the development, marketing, and administration of health insurance, annuity, individual life insurance, and other insurance products for senior and middle-income markets in the United States. The company markets and distributes Medicare supplement insurance, interest-sensitive and traditional life insurance, fixed annuities, and long-term care insurance products; Medicare advantage plans through a distribution arrangement with Humana Inc.; and Medicare Part D prescription drug plans through a distribution and reinsurance arrangement with Coventry Health Care. It also markets and distributes supplemental health, including specified disease, accident, and hospital indemnity insurance products; and life insurance to middle-income consumers at home and the worksite through independent marketing organizations and insurance agencies. In addition, the company markets primarily graded benefit and simplified issue life insurance products directly to customers through television advertising, direct mail, Internet, and telemarketing. It sells its products through career agents, independent producers, direct marketing, and sales managers. CNO Financial Group, Inc. has strategic alliances with Coventry and Humana. The company was formerly known as Conseco, Inc. and changed its name to CNO Financial Group, Inc. in May 2010. CNO Financial Group, Inc. was founded in 1979 and is headquartered in Carmel, Indiana.

Advisors' Opinion: - [By Vanin Aegea]

I have heard many people comment about the insurance policies for cars, houses, life, assets, etc. The arguments always revolve around the same issue: Is it really necessary? What are the chances to be hit by a Hurricane, or to meet a sudden death? Well, nobody really knows. Some individuals however, sleep better when they know a policy backs their life investments. Here, I will look into three insurance companies that concentrate on different policies, or geographies. These are: China Life (LFC), and Conseco (CNO).

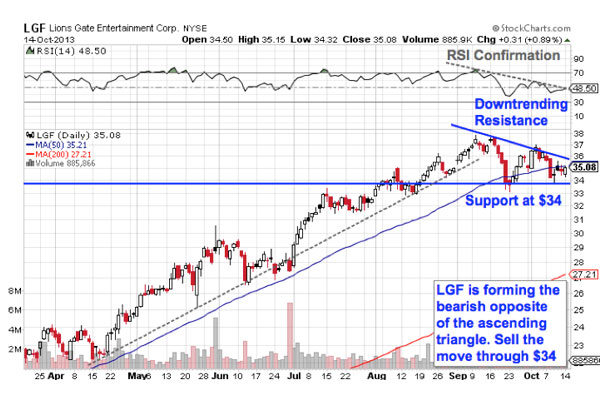

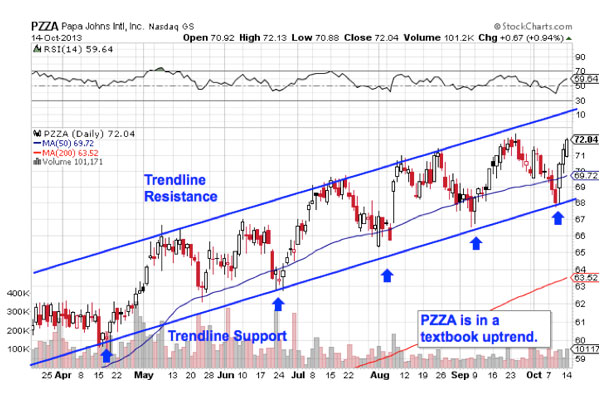

- [By Jonas Elmerraji]

Up first is CNO Financial Group (CNO), a mid-cap financial stock that's rocketed close to 60% higher since the calendar flipped over to January. Yup, it's been a great year for the market, but it's been a far better one for investors who own CNO. But that strong performance isn't showing any signs of slowing yet. In fact, CNO looks primed for even more upside in the fourth quarter.

That's because CNO is currently forming a bullish pattern called an ascending triangle. The ascending triangle pattern is formed by a horizontal resistance level above shares -- in this case at $14.75 -- and uptrending support to the downside. Basically, as CNO bounces in between those two technical price levels, it's getting squeezed closer and closer to a breakout above that $14.75 resistance level. When that breakout happens, it's time to become a buyer.

ACCO's price action isn't exactly textbook. After all, the pattern is coming in at the bottom of a downtrend, not after an uptrend. But ultimately, that doesn't change the trading implications of a move through that $7.50 level.

Whenever you're looking at any technical price pattern, it's critical to think in terms of those buyers and sellers. Ascending triangles and other pattern names are a good quick way to explain what's going on in a stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That $7.50 resistance level is a price where there has been an excess of supply of shares; in other words, it's a place where sellers have been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above it so significant. The move means that buyers are finally strong enough to absorb all of the excess supply above that price level.

Don't be early on this trade.

- [By David Fried, Editor, The Buyback Letter]

Insurance holding company CNO Financial Group (CNO) and its insurance subsidiaries��rincipally Bankers Life and Casualty Company, Washington National, and Colonial Penn Life Insurance Company��erve pre-retiree and retired Americans.

Surveying the damage pictured above: (-7.53%) - Utilities, IDU (-7.63%) - Long-term U.S. Treasury Bonds, TLT (-9.25%) - Master Limited Partnerships, AMJ (-15.96%) - REITs, VNQ The FOMC Spin Cycle Investors feared that sharply rising rates would make the investment options above less attractive in comparison to "risk free" assets like U.S. Treasury bonds. After the initial rout, we saw a remarkable snap-back recovery in all four asset classes displayed above (with the exception of Treasury bonds) as Big Ben pacified the markets with rhetoric and rates eased. Then in July, as speculation centered around Larry Summers as most likely to succeed Bernanke, the 10-year spiked to 3.00% and our dividend-payers fell once more. The key ingredient for these asset classes isn't as simple as "low rates good, rising rates bad." Truly, it's the spread between the yields being kicked off by these investments, taken in comparison with those of the risk-free Treasury.

Surveying the damage pictured above: (-7.53%) - Utilities, IDU (-7.63%) - Long-term U.S. Treasury Bonds, TLT (-9.25%) - Master Limited Partnerships, AMJ (-15.96%) - REITs, VNQ The FOMC Spin Cycle Investors feared that sharply rising rates would make the investment options above less attractive in comparison to "risk free" assets like U.S. Treasury bonds. After the initial rout, we saw a remarkable snap-back recovery in all four asset classes displayed above (with the exception of Treasury bonds) as Big Ben pacified the markets with rhetoric and rates eased. Then in July, as speculation centered around Larry Summers as most likely to succeed Bernanke, the 10-year spiked to 3.00% and our dividend-payers fell once more. The key ingredient for these asset classes isn't as simple as "low rates good, rising rates bad." Truly, it's the spread between the yields being kicked off by these investments, taken in comparison with those of the risk-free Treasury.

+12.47% -- S&P 500 +16.11% -- Emerging Markets, VWO The higher the interest rates the United States pays on its debt, the higher rates these smaller and more economically sensitive nations must pay to attract investment in their own governments' debt. The logic is the same as when companies or borrowers with lower credit ratings have to pay higher interest rates to secure loans. Higher cost of funds creates additional headwinds for their growth; the converse is also true. What if I'm wrong, though? What if Rand Paul filibusters to block Yellen's nomination, or Yellen has a change of heart after accepting her nomination? If rates spike higher again, aren't we going to see the same pain that we endured for the entire month of June? Maybe. The trouble with that argument is you're not just fighting the Fed, whose primary objective is to see solid improvements in the labor market (specifically, an unemployment rate of 6.5%). You are also fighting retirees, endowments, pension funds, foreign governments and mutual funds who may be infinitely more interested in securing 3% on their fixed income portfolios than they are at 2%. Any increased appetite for our government's debt puts downward pressure on the interest rates we must pay to attract investment. Everything is relative. Yellen at the helm bodes well not just for our markets which may be getting a bit extended, but also for our small, foreign counterparts whose recovery is much less mature. As the world's largest economy, the scope of our policies cannot be measured simply by our unemployment rate and GDP growth. In fact, our unemployment and GDP growth depends more on the health of other economies than it ever has before. At the time of publication the author was long AMJ, VNQ & VWO. -- Written by Adam B. Scott This article is commentary by an independent contributor, separate from TheStreet's regular news coverage.

+12.47% -- S&P 500 +16.11% -- Emerging Markets, VWO The higher the interest rates the United States pays on its debt, the higher rates these smaller and more economically sensitive nations must pay to attract investment in their own governments' debt. The logic is the same as when companies or borrowers with lower credit ratings have to pay higher interest rates to secure loans. Higher cost of funds creates additional headwinds for their growth; the converse is also true. What if I'm wrong, though? What if Rand Paul filibusters to block Yellen's nomination, or Yellen has a change of heart after accepting her nomination? If rates spike higher again, aren't we going to see the same pain that we endured for the entire month of June? Maybe. The trouble with that argument is you're not just fighting the Fed, whose primary objective is to see solid improvements in the labor market (specifically, an unemployment rate of 6.5%). You are also fighting retirees, endowments, pension funds, foreign governments and mutual funds who may be infinitely more interested in securing 3% on their fixed income portfolios than they are at 2%. Any increased appetite for our government's debt puts downward pressure on the interest rates we must pay to attract investment. Everything is relative. Yellen at the helm bodes well not just for our markets which may be getting a bit extended, but also for our small, foreign counterparts whose recovery is much less mature. As the world's largest economy, the scope of our policies cannot be measured simply by our unemployment rate and GDP growth. In fact, our unemployment and GDP growth depends more on the health of other economies than it ever has before. At the time of publication the author was long AMJ, VNQ & VWO. -- Written by Adam B. Scott This article is commentary by an independent contributor, separate from TheStreet's regular news coverage.