BALTIMORE (Stockpickr) -- Buyers flexed their muscles in yesterday's market session, pushing the broad market from medium-sized losses in the big indices at the open to medium-sized gains. If you own stocks right now, that's a very welcome sight.

There's a lot of headline risk baked into Mr. Market right now. Between earnings season and the battle that wages on in Congress, there is no shortage of items that could inject volatility into stock prices in October. But buyers' asserting themselves yesterday is a good sign.

Another good sign comes from the technical picture in the broad market. With another big confirmed bounce off of the S&P 500 long-term uptrend line this week, now looks like a good time to be a buyer.

I've said all year long that we're in a "buy the dips market." Well, that was a dip.

But it's not good enough to just say buy stocks in general. That's why we're taking a closer technical look at five individual names with breakout potential this week.

For the unfamiliar, technical analysis is a way for investors to quantify qualitative factors, such as investor psychology, based on a stock's price action and trends. Once the domain of cloistered trading teams on Wall Street, technicals can help top traders make consistently profitable trades and can aid fundamental investors in better planning their stock execution.

So, without further ado, let's take a look at five technical setups worth trading now.

CNO Financial Group

Up first is CNO Financial Group (CNO), a mid-cap financial stock that's rocketed close to 60% higher since the calendar flipped over to January. Yup, it's been a great year for the market, but it's been a far better one for investors who own CNO. But that strong performance isn't showing any signs of slowing yet. In fact, CNO looks primed for even more upside in the fourth quarter.

That's because CNO is currently forming a bullish pattern called an ascending triangle. The ascending triangle pattern is formed by a horizontal resistance level above shares -- in this case at $14.75 -- and uptrending support to the downside. Basically, as CNO bounces in between those two technical price levels, it's getting squeezed closer and closer to a breakout above that $14.75 resistance level. When that breakout happens, it's time to become a buyer.

ACCO's price action isn't exactly textbook. After all, the pattern is coming in at the bottom of a downtrend, not after an uptrend. But ultimately, that doesn't change the trading implications of a move through that $7.50 level.

Whenever you're looking at any technical price pattern, it's critical to think in terms of those buyers and sellers. Ascending triangles and other pattern names are a good quick way to explain what's going on in a stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That $7.50 resistance level is a price where there has been an excess of supply of shares; in other words, it's a place where sellers have been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above it so significant. The move means that buyers are finally strong enough to absorb all of the excess supply above that price level.

Don't be early on this trade.

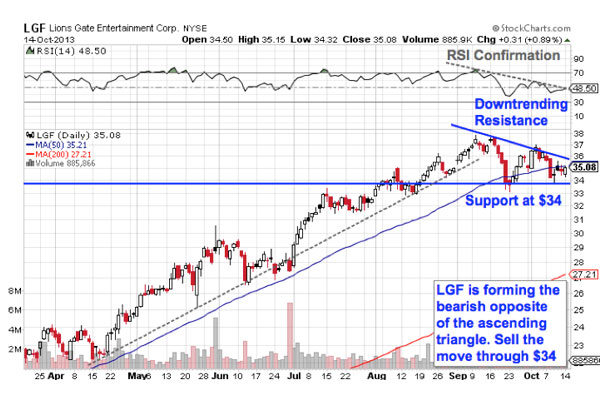

Lionsgate Entertainment

Why bother with introducing a new chart setup when there's another new take on the triangles we've been looking at so far? Lionsgate Entertainment (LGF) is a textbook example of the bearish inverse of the patterns in ACCO and CNO.

Lionsgate currently looks "toppy" thanks to a descending triangle that's been forming in shares since the beginning of September. The descending triangle is formed by a downtrending resistance level above shares and horizontal support, in this case at $34. The breakdown below the $34 price level is the signal to sell (or short) LGF.

Lionsgate's outcome is by no means foregone at this point -- buyers are still showing a willingness to step in and pick up shares at $34. But when LGF can print below that $34 price floor, traders should consider the uptrend officially over. If you decide to short the move, I'd recommend keeping a protective stop on the other side of the 50-day moving average.

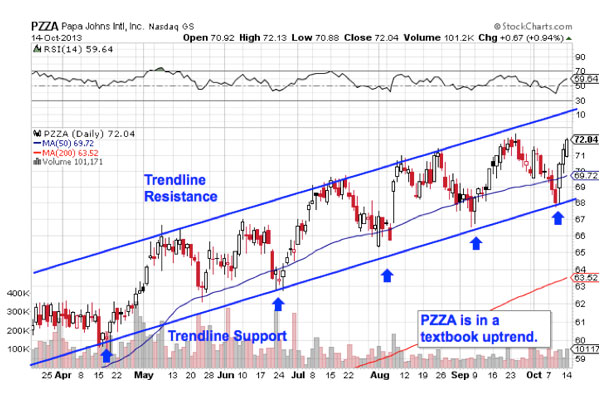

Papa John's International

Small-cap pizza chain Papa John's International (PZZA) has been flashing the green light for buyers since the start of the year, up more than 30% year-to-date. And you don't have to be an expert technical analyst to see why; PZZA bouncing higher in a textbook channel right now.

The channel in Papa John's gives traders a high-probability range for shares to trade within. And while there's really no bad time to buy a stock that's in an uptrend, the ideal time to jump in comes on a bounce off of trendline support. Buying off a support bounce makes sense for two big reasons: it's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong).

While the most recent bounce in PZZA just happened late last week, the fact that buying pressure has been so uncharacteristically strong off of trendline support means that a small correction could be in the cards for traders eyeing a second chance at a low risk entry.

Keep an eye on this one -- and watch out for earnings on Nov. 5.

Dunkin' Brands

Last up on our list is Dunkin' Brands (DNKN), another high-flier this year that's been making its way higher in a well-defined uptrend. Since the start of the year, DNKN has been swatted higher off of support seven times. More touches of support are the biggest key that a support level is significant -- it indicates that buyers are eager enough to keep throwing out bids along that demand line.

The strategy to enter DNKN is just like the plan for PZZA. Ideally, you want to come in on a bounce off of trendline support. But since Dunkin's channel is comparatively wider than Papa John's, there's enough upside room to warrant being a buyer at these prices.

Just remember that all trendlines do eventually break, and when this one does, it's critical to keep your exit strategy ready to go. Unload shares if they can't hold out above the 50-day moving average.

To see this week's trades in action, check out the Technical Setups for the Week portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

No comments:

Post a Comment