DELAFIELD, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for $10 a share or less don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

Just take a look at some of the hot movers in the under-$10 complex from Wednesday, including Astex Pharmaceuticals (ASTX), which skyrocketed higher by 23.7%; Hanwha Solarone (HSOL), which soared higher by 16.3%; JA Solar (JASO), which ripped higher by 15.9%; and Amtech Systems (ASYS), which trended up by 15.6%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

One low-priced stock that recently spiked sharply higher was solar player ReneSola (SOL), which I highlighted in Aug. 22's "5 Stocks Under $10 Set to Soar" at around $4.30 per share. I mentioned in that piece that shares of SOL had been uptrending very strong for the last four months and change, soaring higher from its low of $1.25 to $4.85 a share. This stock had recently pulled back off that $4.85 high to $3.52 a share. Shares of SOL were just starting to bounce off that $3.52 low and were quickly moving within range of triggering a breakout trade above some near-term overhead resistance levels at $4.25 to $4.50 a share and then above its 52-week high at $4.85 a share.

Guess what happened? Shares of SOL stared to flirt with that breakout during the next few trading sessions after the stock hit $4.73 a share. Then on Aug. 30, shares of SOL cleared all of those key resistance levels with massive upside volume. As I write this, SOL has hit an intraday high of $5.90 a share, which represents a big gain of 35% since the stock was trading at $4.30 a share. That's a massive run in a very short timeframe for anyone who played this breakout setup. Shares of SOL could still easily hit $7 to $8 a share in the coming months, since the uptrend for the stock is still intact and volume flows remain bullish.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

I'm not as eager to recommend investing long-term in stocks that trade less than $10 a share because these names can be very speculative, and the odds for picking the long-term winners aren't great. But I definitely love to trade stocks that are priced below $10. I like to view them as a trading vehicle with lots of volatility and lots of upside when the trade is timed right.

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to trade higher from current levels.

LDK Solar

One under-$10 name that's starting to move within range of triggering a near-term breakout trade is LDK Solar (LDK), a vertically integrated manufacturer of PV products for polysilicon, wafers, cells, modules, systems, power projects and solutions. This stock is off to a decent start in 2013, with shares up 13.1%.

If you take a look at the chart for LDK Solar, you'll notice that this stock has been trending range bound and consolidating for the last month and change, with shares moving between $1.42 on the downside and $2 a share on the upside. Shares of LDK have just started to trend back above its 50-day moving average at $1.55 a share with decent upside volume flows. That move is quickly pushing shares of LDK within range of triggering a near-term breakout trade above a key downtrend line that has acted as resistance for a few months.

Traders should now look for long-biased trades in LDK if it manages to break out above some near-term overhead resistance levels at $1.78 to $1.83 a share and then once it clears more resistance at $2 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 1.97 million shares. If that breakout triggers soon, then LDK will set up to re-test or possibly take out its next major overhead resistance levels at $2.17 to its 52-week high at $2.32 a share. Any high-volume move above $2.32 to $2.36 will then give LDK a chance to tag $3 to $3.50 a share.

Traders can look to buy LDK off any weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at its 200-day moving average of $1.46 or at $1.42 a share. One can also buy LDK off strength once it clears those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Nordic American Tankers

Another shipping player that's starting to trend within range of triggering a near-term breakout trade is Nordic American Tankers (NAT), an international tanker company that owns approximately 20 modern double-hull Suezmax tankers, including four newbuilding vessels. This stock is off to a slow start in 2013, with shares off by 7.7%.

If you take a look at the chart for Nordic American Tankers, you'll notice that this stock has been downtrending badly for the last month and change, with shares dropping from its high of $10.31 to its recent low of $7.65 a share. During that downtrend, shares of NAT have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of NAT have just started to bounce higher off that $7.65 low and it's quickly moving within range of triggering a near-term breakout trade. This bounce could be signaling that the downside volatility for NAT is over at least in the near-term.

Market players should now look for long-biased trades in NAT if it manages to break out above its 50-day moving average at $8.50 and then once it takes out its 200-day moving average at $8.63 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average volume of 1.01 million shares. If that breakout triggers soon, then NAT will set up to re-test or possibly take out its next major overhead resistance levels at $9.89 to $10.31 a share.

Traders can look to buy NAT off any weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support at $7.65 a share. One can also buy NAT off strength once it clears those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Merrimack Pharmaceuticals

One under-$10 biopharmaceuticals player that's just starting to trigger a breakout trade is Merrimack Pharmaceuticals (MACK), which focuses on discovering, developing and preparing to commercialize medicines paired with companion diagnostics for the treatment of serious diseases, with an initial focus on cancer. This stock has been hit hard by the bears so far in 2013, with shares off by 38%.

If you take a look at the chart for Merrimack Pharmaceuticals, you'll notice that this stock has been downtrending badly for the last two months, with shares plunging from its high of 7.09 to its recent low of $3.26 a share. During that move, shares of MACK have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of MACK have just formed a double bottom chart pattern at $3.26 to $3.32 a share and it's now starting to break out above some near-term overhead resistance at $3.64 a share. This move could be signaling a trend change for MACK as the stock starts to move higher off oversold conditions.

Traders should now look for long-biased trades in MACK if it manages to break out above some near-term overhead resistance at $3.64 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action of 1.87 million shares. If that breakout triggers soon, then MACK will set up to re-test or possibly take out its next major overhead resistance level at its 50-day moving average of $4.75 a share. Any high-volume move above that level and above more resistance at $5.06 will then give MACK a chance to tag its 200-day moving average at $5.71 a share.

Traders can look to buy MACK off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $3.32 or at $3.26 a share. One can also buy MACK off strength once it clears $3.64 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Forest Oil

Another under-$10 name in the energy space that's starting to move within range of triggering a big breakout trade is Forest Oil (FST), which is engaged in the acquisition, exploration, development, and production of natural gas and liquids in North America. This stock has been under selling pressure so far in 2013, with shares off by 16%.

If you take a look at the chart for Forest Oil, you'll notice that this stock has been uptrending strong for the last two months, with shares moving higher from its low o $3.77 to its recent high of $5.73 a share. During that move, shares of FST have been consistently making higher lows and higher highs, which is bullish technical price action. This stock has now started to spike back above its 200-day moving average of $5.52 a share and it's quickly moving within range of triggering a big breakout trade.

Market players should now look for long-biased trades in FST if it manages to break out above some near-term overhead resistance at $5.73 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action of 3.77 million shares. If that breakout triggers soon, then FST will set up to re-test or possibly take out its next major overhead resistance levels at $6.52 to $7.40 a share.

Traders can look to buy FST off weakness to anticipate that breakout and simply use a stop that sits right below some near-term support at $5.32 a share or below its 50-day at $5.01 a share. One can also buy FST off strength once it clears $5.73 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

L&L Energy

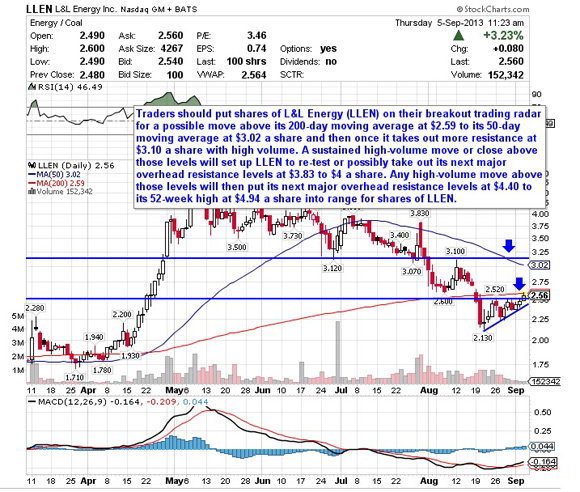

One final under-$10 coal player that looks ready to trigger a major breakout trade is L&L Energy (LLEN), which, through its subsidiaries, engages in the production, processing and sale of coal in the People's Republic of China. This stock is off to a hot start so far in 2013, with shares up 34%.

If you take a look at the chart for the L&L Energy, you'll notice that this stock has been downtrending badly for the last four months, with shares falling from its high of $4.94 a share to its recent low of $2.13 a share. During that downtrend, shares of LLEN have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of LLEN have now started to rebound off that $2.13 low and it's quickly moving within range of triggering a major breakout trade. If this rebound holds, then it could mean the downside volatility for LLEN is over in the short-term.

Traders should now look for long-biased trades in LLEN if it manages to break out above its 200-day moving average at $2.59 to its 50-day moving average at $3.02 a share and then once it takes out more resistance at $3.10 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 646,402 shares. If that breakout triggers soon, then LLEN will set up to re-test or possibly take out its next major overhead resistance levels at $3.83 to $4 a share. Any high-volume move above those levels will then put its next major overhead resistance levels at $4.40 to its 52-week high at $4.94 a share into range for shares of LLEN.

Traders can look to buy LLEN off weakness to anticipate that breakout and simply use a stop that sits right that recent low of $2.13 a share. One can also buy LLEN off strength once it clears those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

No comments:

Post a Comment