You know what they say: Your home is your castle. Kirkland's, Inc. (KIRK) is perfectly situated to cash in on the growing trend of consumers spending on their homes again. This Zacks Rank No. 1 (Strong Buy) recently raised full-year guidance. Kirkland's operates 317 home decor stores in 35 states. Founded in Tennessee in 1966, its focus is on the Southeast. It carries home items such as framed art, mirrors, candles, lamps, accent rugs, and garden accessories, as well as seasonal merchandise.

Big Second-Quarter Earnings Beat

On Aug. 22, Kirkland's reported its second-quarter results and blew past the Zacks Consensus Estimate by 70%. Earnings were a loss of 3 cents compared to the Zacks Consensus, which was looking for a loss of 10 cents. Sales rose 6.7% to $97.1 million compared with the year-ago period. Gross margins rose to 36.7% on reduced promotions. While traffic remains a "challenge," the company believes it has a strong brand, which should extend recent gains into the second half of the year.

Raised Full-Year Guidance

After a better-than-expected second quarter, Kirkland's raised its full-year EPS guidance to the range of $0.80-$0.90 from $0.75-$0.85. Four estimates have been raised since the report, which has pushed the Zacks Consensus Estimate up to $0.91 from $0.83. The analysts are bullish as that is a penny above the new guidance range. That's earnings growth of 22.3% in fiscal 2013.

Long-Term CEO to Retire

One issue to keep an eye on is the search for a new president and CEO. In March 2013, the company announced that CEO and President Robert Alderson, who had been with the company for 27 years, was going to retire at the end of the fiscal year. In retail speak, that means Feb. 1, 2014. Analysts and investors can get jittery at the prospect of losing a long-time leader. But Kirkland's has given itself nearly a year to find a successor, which has calmed nerves. Look for an announcement on his replacement soon.

Cash Is King

Kirkland's ! is also one of those rare companies that has no debt. This is especially impressive for a retailer that is always opening new stores. As of the end of the second quarter, Kirkland's had $63 million in cash on hand.

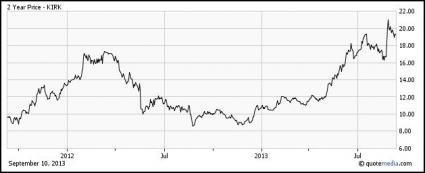

Two-Year High

After the company beat and raised full-year guidance, shares spiked to two-year highs.

It's trading with a forward P/E of 21.3, but its price-to-sales ratio is just 0.7. A P/S under 1.0 usually designates value. For investors looking for ways to play the return to "nesting" and a focus on the home, Kirkland's just might be the retailer to zero in on.

Kirkland's: Free Stock Analysis Report (email registration required)

Source: Bull Of The Day: Kirkland's

No comments:

Post a Comment